The Hidden Economics of Poor Visibility How Blind Spots Drain Value (And What to Do About It)

- gsriram87

- Aug 22, 2025

- 3 min read

Updated: Sep 24, 2025

Supply chains often look strong on paper—suppliers contracted, parts ordered, timelines committed. But beneath that veneer lurks a silent drain: hidden costs from poor visibility. When disruption strikes, it’s too late to react. What you thought was a small slip becomes a systemic failure. This is not just an operational inconvenience—it’s an economic leak, a value hemorrhage, a strategic vulnerability.

1. A Moment of Truth: When Blind Spots Become Bottlenecks

Imagine this: a critical microcontroller supplier in Tier‑3 faces a power outage. The Tier‑2 supplier doesn’t tell the OEM until delays cascade downstream. Suddenly, assembly lines halt. Freight is rushed. Contracts incur penalties. Production backlog grows. The OEM loses margin, credibility, and perhaps even contracts. None of this showed in ERP dashboards because that supplier was considered 'off radar.'That scenario isn’t fantasy—it’s déjà vu for many supply chain veterans. And that’s the problem visibility is meant to fix.

2. The Hidden Costs That Bask in Darkness

Let’s break down what 'economics' really hides behind visible metrics:- Emergency premium spend: sourcing substitutes or expedited freight at more than double the cost.- Contractual penalties & fines: service-level failures or regulatory breaches often trigger steep charges.- Opportunity cost: firefighting takes away capacity for growth or new deals.- Working capital drag: buffer inventory to offset uncertainty ties up cash and reduces agility.- Insurance and financing premiums: uncertainty drives up risk pricing for loans, bonds, and insurance.- Brand & customer erosion: recurring unreliability nudges customers toward competitors.- Sub-supplier ripple effects: one unseen breakdown cascades through downstream tiers.

3. Case Illustrations: When Visibility Fails and When It Saves

Two anonymized examples make this tangible:- Case A: Electronics OEMA Tier‑2 capacitor supplier faced a raw material shortage. Because the OEM lacked visibility into that supplier’s pipeline, the delay wasn’t noticed until downstream lines stalled. Backup parts had to be sourced at twice the cost, and 10% of units were scrapped.- Case B: Auto Assembly ImpactA casting foundry (Tier‑3) suffered a flooding event. The OEM only learned when its Tier‑2 halted. The OEM diverted parts from alternates at premium cost, paid extra logistics, and absorbed several days of lost output. Earlier awareness could have allowed order resequencing and faster supplier recovery.

4. Why Even Firms That Know the Cost Stall

If the economics are this stark, why don’t more firms succeed with visibility? The answer: execution gaps.- Siloed functions: procurement, ops, and finance rarely align on visibility goals.- Supplier friction: suppliers fear overexposure.- Tech fragmentation: legacy ERPs and disconnected tools slow integration.- Scope creep: trying to map 'all suppliers' at once leads to paralysis.- Invisible ROI: benefits surface only in crises, making skeptics reluctant to invest.

5. Reframing Visibility as a Financial Lever

Visibility isn’t just about avoiding costs—it’s a financial lever. CFOs already measure:- Days Payable Outstanding (DPO)- Cash Conversion Cycle (CCC)- Buffer inventory costs- Margin erosion from premium buys- Earnings volatilityImproved visibility reduces buffers, optimizes working capital, and anticipates costly disruptions. It converts uncertainty into predictable outcomes—something finance leaders value immensely.

6. Visibility Enables Strategic Moves

Deeper visibility empowers companies to:- Step in early to assist fragile suppliers (financing, logistics, raw materials).- Launch supply chain finance programs for vulnerable nodes.- Build trust-based collaboration, encouraging suppliers to share signals sooner.- Push sustainability & compliance deeper than Tier‑1.- Optimize pricing and responsiveness with accurate, real-time constraints.

7. Five Principles for Effective Visibility Programs

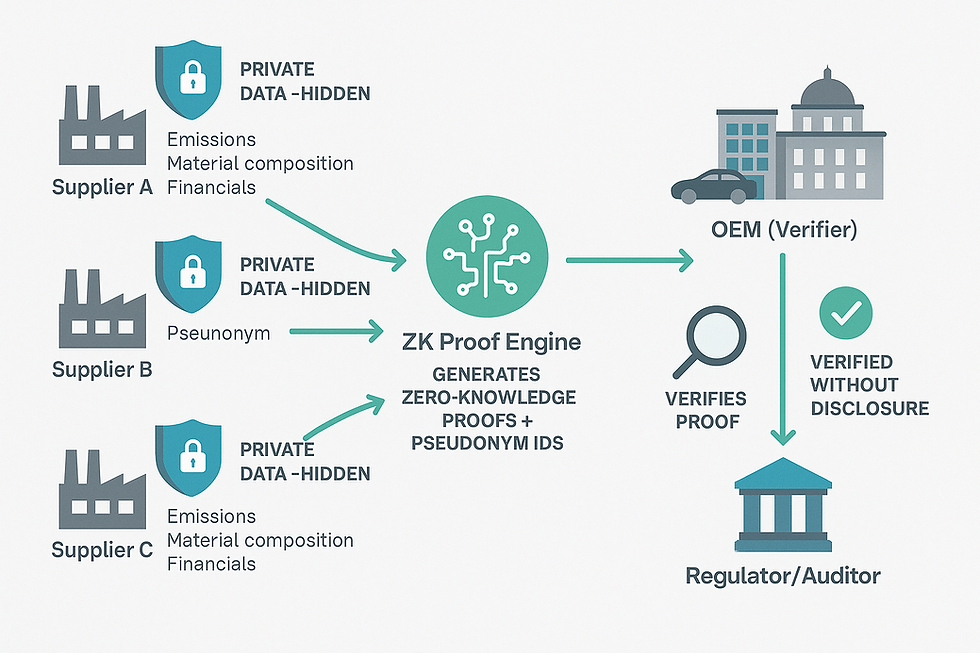

Execution can be guided by five principles:1. Start small and go deep: focus on 20–50 high-risk parts first.2. Trust by design: pseudonyms, privacy filters, aggregated reporting.3. Align incentives: explain benefits in finance, ops, and procurement terms.4. Use lightweight tech: mobile apps, APIs, supplier inputs before heavy portals.5. Iterate fast: pilot, gather feedback, refine, scale gradually.

8. Final Thoughts

Visibility rarely earns headlines until it saves a business from collapse. But its hidden economics are very real—eroding margins, suppressing growth, and weakening competitive position.With focus, aligned incentives, and modern tools, visibility evolves from an afterthought to a financial lever. One that not only prevents losses but opens the door to resilience, opportunity, and trust.

In the next post, we’ll examine why many visibility programs stall and how successful OEMs design programs that actually deliver.

Comments