Why N‑tier Supplier Visibility Isn’t Just a Buzzword

- gsriram87

- Aug 20, 2025

- 3 min read

Updated: Sep 9, 2025

The hook

A $5 part can stop a $50,000 product. In 2021, the auto industry alone wrote off roughly $210B in revenue and millions of unbuilt vehicles from upstream shortages. Plants running Just‑in‑Time can bleed tens of thousands of dollars per minute when a single sub‑tier supplier stumbles. So no — “N‑tier visibility” isn’t a trend piece. It’s table stakes for competitiveness.

What we mean by N‑tier visibility

It’s practical, not mystical: knowing who your suppliers’ suppliers are (and sometimes their suppliers), what they’re working on for you right now, and which risks could knock them off plan. Concretely, it’s a living map of:

· relationships (Tier‑1 → Tier‑2 → Tier‑3),

· part flows and dependencies (by part ID/BOM),

· status signals (milestones, delays, capacity constraints), and

· early warnings aligned to the exact assemblies and plants they affect.

Why it matters right now

Supply networks aren’t chains; they’re webs. Critical tiers are concentrated (the “diamond” pattern), suppliers cross‑serve multiple modules and plants, and shocks travel fast. The financial reality is simple: late discovery forces premium buys, rush logistics, overtime rework, and lost sales — all margin killers. Early discovery converts the same events into manageable plan changes.

Current state (and why most programs stall)

Many firms map Tier‑1 thoroughly, dabble in Tier‑2 for a handful of critical parts, and stop. Common blockers:

· Heterogeneous ERPs and spreadsheets across sub‑tiers (integration fatigue).

· Trust barriers — suppliers fear penalties or disintermediation.

· Gatekeeping by Tier‑1s; unclear governance for OEM–sub‑tier collaboration.

· ROI skepticism: resilience is valuable, but the benefits feel “invisible” until a crisis.

Mini‑caselets (the pattern repeats)

• A single Tier‑2 fire at a brake‑valve supplier once threatened to halt national production — multi‑party collaboration recovered in days.• During the chip shortage, OEMs who sensed constraints early secured allocation and kept lines running; laggards ceded share.• Some manufacturers rewired firmware to use alternative chips — proof that time‑to‑signal creates room for creative mitigation.

What “good” looks like (without boiling the ocean)

A pragmatic playbook your team can start this quarter:

1. Start narrow, go deep: map Tier‑2/3 for the top 50–100 bottleneck parts by revenue risk.

2. Instrument the flow: collect 3 lightweight signals per cycle (start, mid‑cycle status, dispatch) per sub‑tier — mobile or portal, not big‑bang IT.

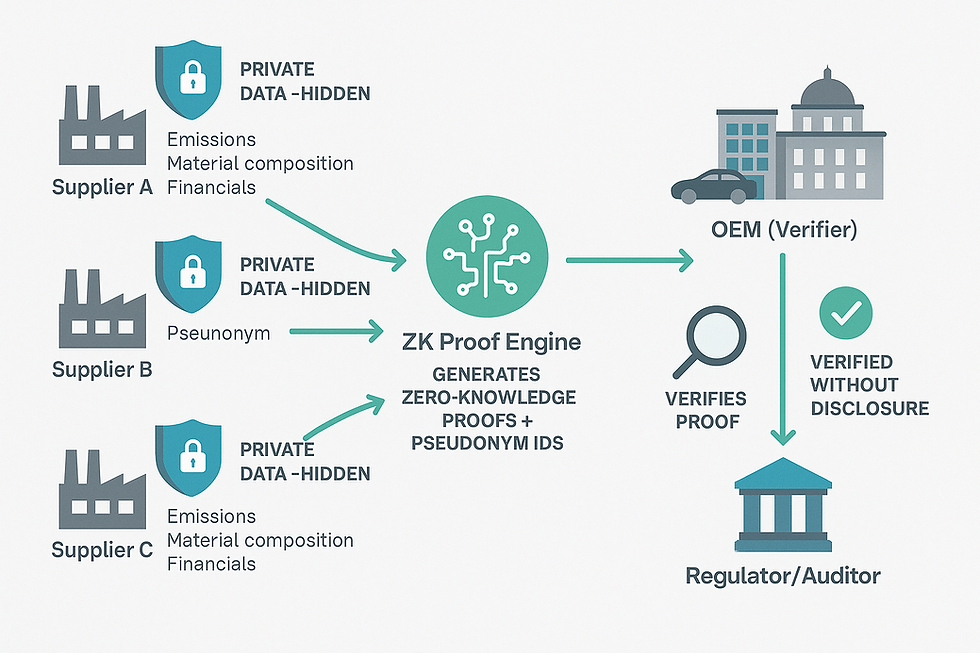

3. Trust by design: allow pseudonymous sharing of status where identity sensitivity exists; make the default response to early flags “help first, not punish.”

4. Make the network computable: model parts, suppliers, plants, and dependencies in a graph so you can ask “who is impacted if X slips?” in seconds.

5. Fuse early‑warning feeds: enrich the map with external risk signals (weather, labor, geopolitics) and match them to affected parts and plants.

6. Operationalize the loop: when a risk fires, a pre‑baked playbook triggers (alt‑source, pull‑ahead builds, re‑sequence, or planned expedites).

How to talk about it in CFO language

Track a small set of outcome metrics — and review them monthly:

· Lead‑time risk pulled forward (days between first signal and planned need).

· Avoided expedite cost vs. baseline (freight + spot‑buy deltas).

· Line‑time preserved (% uptime on constrained programs).

· Working capital efficiency (buffer stock reduced without service loss).

· Reliability win‑rate (share of competitive deals won on delivery confidence).

Voice & intent

We’re not selling software here. We’re sharing an operator’s pattern: sense earlier, decide faster, act together. Veterans know heroics; this is about fewer fires, better math, and a calmer S&OP.

Bottom line

N‑tier visibility isn’t about seeing problems for the sake of it. It’s about earning time — the scarcest resource in a disruption — and converting it into options. Do that repeatedly, and visibility stops being a buzzword and starts being an edge.o ‘visibility’ projects stall—long before they deliver visibility and how the winners avoid it?

Comments